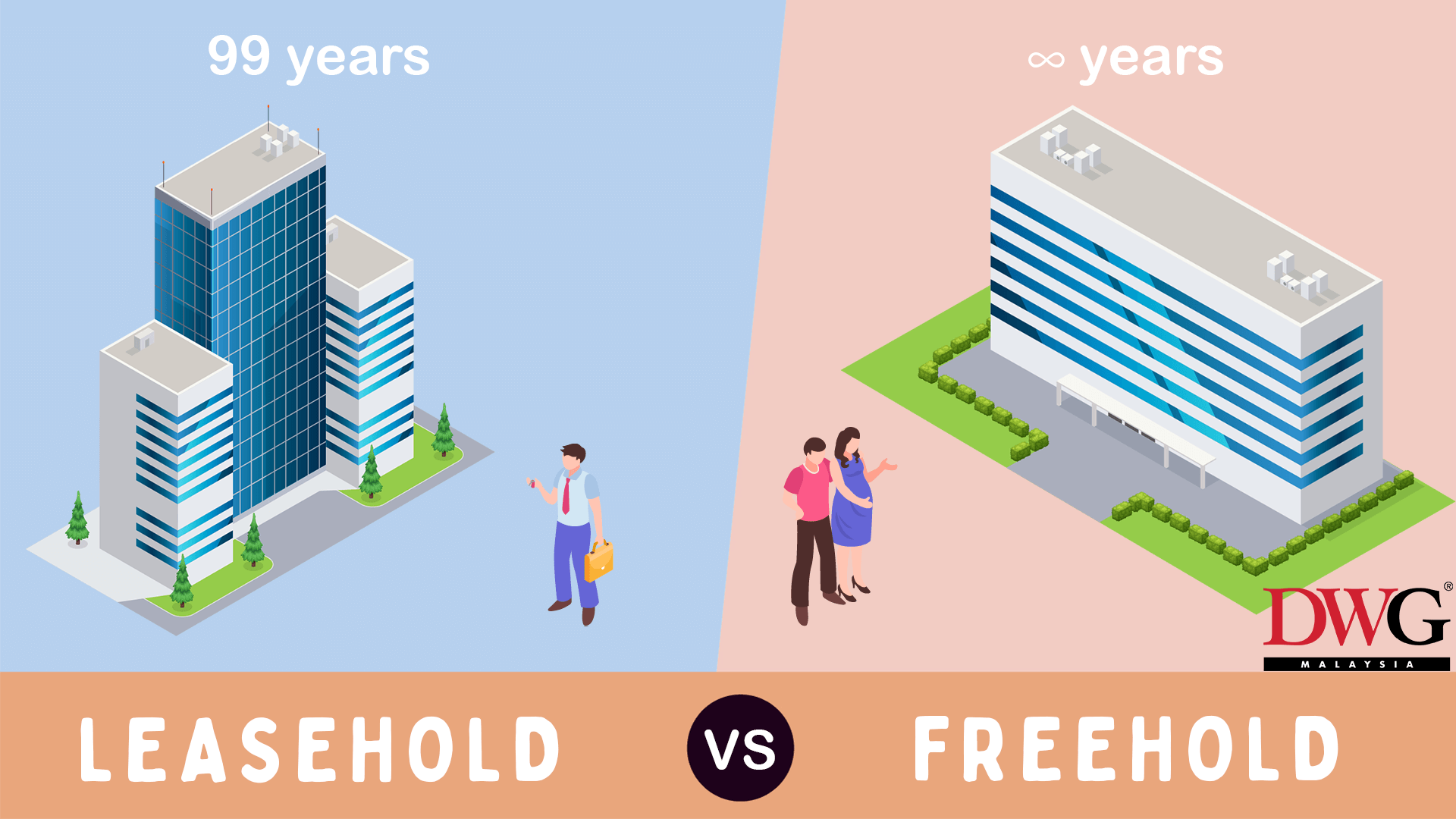

Freehold vs Leasehold in Malaysia: What's the difference?

If you have recently been actively searching for properties online, you’ve probably seen at least 1 to 2 ads with huge headlines/descriptions along the lines of ‘FREEHOLD PROPERTY’. Although, you probably haven't seen any ‘LEASEHOLD PROPERTY’ descriptions or headlines in advertisements, making it seemingly the less desirable option between the two.

If that strikes you as odd, and you want to know more, then let’s get to it.

Freehold Property

Freehold property refers to a piece of land or property transferred by the government indefinitely to an individual, giving it a freehold title. The freehold property owner has full rights to the land and can do with it as they please within the bounds of Malaysian law.

For condominium or high-rise properties, the developer initially owns the land (master title) during the development of the property. It will then be distributed into strata title (common area) and individual title (private area; home interior) respectively to individual home-buyers once the property has been completed. You can imagine it as a whole cake (master title) that the developer initially owns, then sliced into smaller pieces (strata title and individual title) for the individual home-buyers.

“Wow, I can own a property indefinitely with a freehold title and pass it down to my children or future generations?”

Unfortunately, not entirely so. There’s a catch.

As stated in the Land Acquisition Act 1960, the ownership of freehold land is transferable to the government for the economic advancement of the public and nation. There have been instances in the past where the government has reclaimed these homes to further the country's development, such as the construction of the LRT or MRT. But if the government ever needs to take the land your home is on, rest assured, the government will appoint a professional market valuer to assess the current value of the land and will compensate you for it.

Leasehold property

A leasehold property is a type of property ownership whereby the individual holds the right to use the land for a limited period ranging from 30, 60, or 99 years. This includes the time from when the developer purchases the land to developing the property before handing it over to individual home-buyers. For example, suppose a developer bought the land with 99 years of leasehold tenure 10 years ago and takes another 5 years to develop the property before ultimately handing it over to you as the buyer. In that case, you will only be left with 84 years of ownership.

99 years of Leasehold tenure

Developer purchase land: 10 years

The developer develops land: 5 years

Balance: 84 years

Although, there are developers renewing the leasehold tenure once they have completed the project so their homebuyers can enjoy 99 years of ownership of their properties.

“So what happens when the leasehold tenure runs out? Will I, my children, or my future generations be left homeless?”

Fortunately, not necessarily true. Here's the silver lining.

You may apply for an extension of the lease with the Land Office of Malaysia by submitting the relevant documentation and paying a fee. However, you must remember that if the government has other plans for the area, they may choose not to extend your lease.

Comparing freehold and leasehold

| Freehold | Leasehold | |

|---|---|---|

| Tenure | ∞ | 30, 60 or 99 years |

| Property Value | Better capital appreciation in the long run due to no limitation on property tenure but lower rental yield due to higher cost of entry | Better rental yield due to lower cost of entry compared to freehold properties, but the value of property depreciates over time as the lease period comes to an end |

| Ease of selling the property | The transaction process is more straightforward, which usually takes 3+1 months to complete, as stated in standard SPA | Buying and selling a leasehold property is more time-consuming as it requires state consent and approval |

Which is better for you?

The comparison above shows that both types of property ownership titles have pros and cons, and which is better for you ultimately depends on your personal need and preference. However, if you are just looking for a different perspective, here’s the writer’s opinion on this matter:

“Freehold is a fantastic option for your own stay (especially for parents with kids) as you do not need to worry about the leasehold tenure running out on you, and you will have an asset (sort of like a legacy) to pass down to your children or your future generations. Also, there is significant capital appreciation if you purchased the right property in a prominent township. Meanwhile, Leasehold is an excellent option if you are looking for an investment property due to the lower upfront costs and often bigger units compared to freehold properties, allowing you to have the margin to profit from rental yield. Depending on which property and location you invested in, you should be able to make a decent return on investment from the leasehold property if managed correctly.”

This article is provided for informational purposes only, and DWG Malaysia makes no representations or warranties regarding the accuracy, completeness, or fairness of the information contained herein. This article is written in general and is not intended to address the circumstances of any particular individual or entity.