Home Loan Insurance in Malaysia - MRTA, MLTA, MRTT, and MLTT

When it comes to taking a home loan, most people would only focus on securing the best interest rate and loan tenure that fits their needs. However, another important factor that people should take into consideration is home loan insurance.

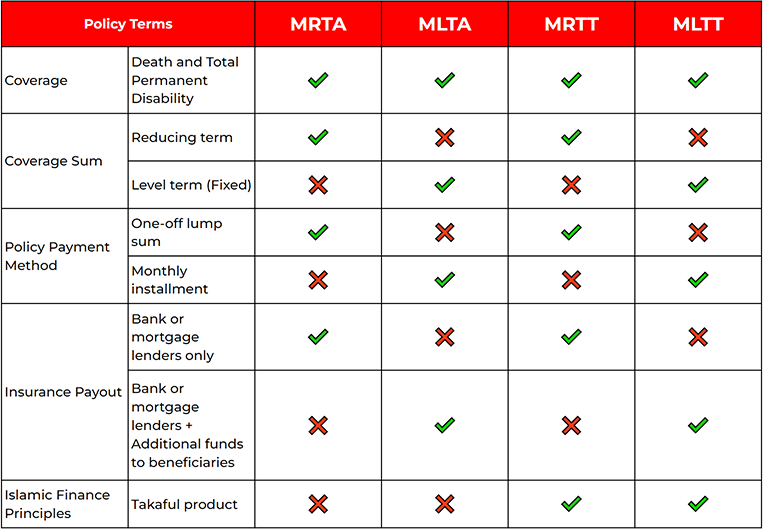

There are currently 4 types of home loan insurance in Malaysia – MRTA, MLTA, MRTT, and MLTT. This protects the banks or mortgage lenders from borrowers’ default, ensuring that the lenders will still receive their money even if the borrower is unable to repay the loan due to unforeseen occurrences such as death or total and permanent disability.

Each type of insurance has its own benefits and coverage, so it’s essential to understand the disparity between them before deciding which one to get.

Keep reading to learn everything you need about Malaysia's home loan insurance!

1.0 MRTA - Mortgage Reducing Term Assurance

Mortgage Reducing Term Assurance (MRTA) is a type of home loan insurance in which the sum insured decreases over the term of your home loan. It is an important financial product for homeowners, as it can help your loved ones reduce or cover the total outstanding loan in any event of death or Total Permanent Disability (TPD).

As you repay your home loan, the value of your outstanding debt will reduce. MRTA is structured so that the amount that would be paid out upon making a claim covers the total value of your then-outstanding home loan.

If the amount you are insured for under MRTA is lower than your home loan at the time of claim, the amount paid out by MRTA may not cover the entire outstanding loan amount. Alternatively, suppose you are insured for an amount that is greater than the outstanding home loan amount. In that case, the home loan provider will only receive the amount owed, with no additional benefit paid.

Death or TPD will only pay off home loan within years of coverage

Scenario 1

If a homebuyer paid for MRTA for an insurance term of 20 years coverage, serving a home loan of 35 years, in any event, that death occurs during the 20 years of coverage, the outstanding balance would be paid off.

Scenario 2

If a homebuyer paid for MRTA for an insurance term of 20 years coverage, serving a home loan of 35 years, in any event, that death occurs after 20 years of coverage (for instance, 21 years), the outstanding balance would NOT be paid off. In that case, the beneficiary of the home will need to pay off the outstanding balance home loan in a lump sum or installment payment.

What’s interesting about MRTA is that there is no fixed price for it because it is structured in a way just to pay off your home loan! The cost varies depending on factors such as age, health conditions, the value of your home loan, and the length of your home loan.

2.0 MLTA - Mortgage Level Term Assurance

Mortgage Level Term Assurance (MLTA) is a type of insurance that pays out a defined amount upon death or total permanent disability during the policy period.

MLTA policies are level-term life insurance policies, meaning the death benefit remains the same (fixed amount) throughout the policy term.

Death or TPD within any period of time during the policy term will be insured for a fixed amount

Scenario 1

If a homebuyer purchased MLTA for insurance coverage of RM500,000, in any event, that death occurs with an outstanding balance home loan of RM300,000. MLTA will pay off RM300,000 for the home loan, and the balance of RM200,000 will be reimbursed to the beneficiary of the policy.

Scenario 2

If a homebuyer purchased MLTA for insurance coverage of RM500,000, in any event, that death occurs with an outstanding balance home loan of RM450,000. MLTA will pay off RM450,000 for the home loan, and the balance of RM50,000 will be reimbursed to the beneficiary of the policy.

As explained in both scenarios, MLTA pays out a fixed value regardless of the outstanding balance of the home loan with any additional insured amount to the beneficiary. Unlike MRTA, which only pays for the outstanding home loan to the bank or mortgage lenders.

Although, the cost of MLTA also varies depending on factors such as age, the fixed amount insured, and the policy's term.

3.0 MRTT - Mortgage Reduction Term Takaful

Like MRTA, Mortgage Reduction Term Takaful (MRTT) helps reduce your mortgage balance in the event of your death or total permanent disability. The only difference is that it is an Islamic-compliant product based on the principles of takaful.

MRTT works by paying a lump sum at the start of the home loan, which is then used to insure your mortgage balance in the event of your death. The amount of money paid into the fund is based on your age, the amount of your mortgage, and the term of your mortgage. So if you're looking for a way to reduce the term of your mortgage while still protecting your family, MRTT may be a great option to fulfill both factors.

4.0 MLTT - Mortgage Level Term Takaful

Like MLTA, Mortgage Level Term Takaful (MLTT) is a Muslim-compliant insurance product that pays out a fixed amount during the policy term, which helps protect your family's finances in the event of your death or total permanent disability. It is designed to pay off your outstanding mortgage balance with any additional sum insured paid to your beneficiary so that your loved ones are not burdened with this financial responsibility.

The insurance cover sum in this policy will stay the same throughout the policy period. MLTT is an Islamic finance product that guarantees how much will be paid out throughout the plan.

It stipulates a guaranteed payment value, meaning the insurance sum paid out on a claim is the same in the first year as in the last year of the cover.

5.0 MRTA vs MRTT / MLTA vs MLTT

MRTA and MRTT serve the same purpose of covering the home loan payment in a reducing term manner throughout the policy.

Likewise, MLTA and MLTT offer the same function of paying out a defined amount in any event of death or total permanent disability.

Both offer the same benefits with similar term coverage; the only difference is Takaful and non-Takaful products. MRTT and MLTT are Islamic versions of MRTA and MLTA designed on sharia-compliant finance principles, which reflects how individuals are responsible for cooperating and protecting one another by restrictions on riba (interest), and gharar (excessive uncertainty) principles.

6.0 MRTA, MLTA, MRTT, MLTT Comparison

While home loan insurance is not required by law, most banks and mortgage lenders will require you to have it in place before they offer you a mortgage. Should you not opt for it, they will reject your home loan application or offer a home loan with a much higher interest rate due to a riskier borrower profile. This is because they want to ensure that your family can keep up with your mortgage payments if something happens to you.

Since everyone faces different circumstances, there is no single ‘best’ home loan insurance. It all depends on what works best for you and your family. You have to evaluate the different options and decide which policy will support your loved ones most during unfortunate events. If you are unclear about which insurance coverage is right for you, you may call the bank or mortgage lenders for advice on home loan insurance or consult a financial expert.